The most common types of qualified organizations are section 501c3 organizations such. The service has revised form 1098 c which is used to provide the written acknowledgment.

How Do Tax Deductions Work When Donating A Car

How Do Tax Deductions Work When Donating A Car

Filing a car donation tax deduction.

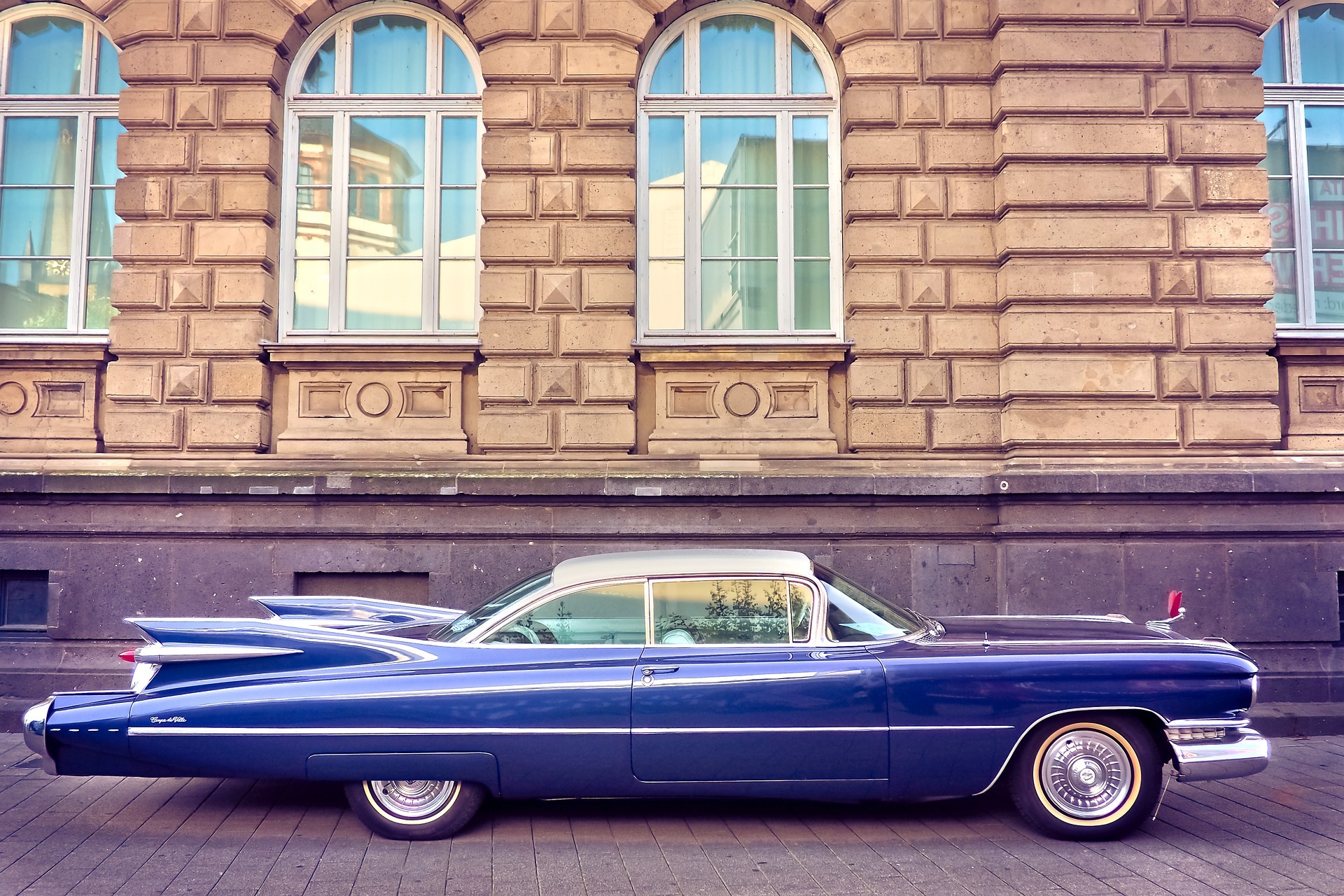

Can you donate a car for tax write off. There are lots of reasons to donate a vehicle even beyond potential car donation tax write offs. A tax exempt donation is a charitable donation you can claim as a tax write off. If you would like to help your local make a wish and get the maximum tax deduction then youre already almost done.

Donating your old set of wheels to a charity can be a bit tricky but if you do it correctly you can write it off. Among the irss recommendations for donating your vehicle are. Yes any company or individual can donate a car and use it as a tax write off.

Donating your car to charity can result in significant tax savings if you include it in your charitable contribution deduction. A tax deduction later and you want to claim a deduction for donating your car to charity then you should make certain that the charity is a qualified organization. The cars current market value may be negligible to you.

There are many charities requesting vehicle donation and it is a great way to give back to the community. Irs guidance explains rules for vehicle donations. Donating your vehicle might also seem like an easier way to get it off your hands.

Donating your car or vehicle to charity can be a great way to get a 2019 federal tax deduction state income tax deductibility depends on state law and wheels for wishes makes it easy. Finally notice 2006 1 provides guidance on the new penalties imposed on donee organizations that provide a false or fraudulent acknowledgment of a vehicle donation or fail to furnish the acknowledgment properly. And even if it is you may still be unable to get a tax exemption if you dont follow proper procedures.

However doing a little planning will ensure that you maximize the tax savings of your donation. For a car worth more than 500 the amount you can deduct is generally the lower of either how much the organization resells it for or its fair market value on the donation date. Otherwise your donation will not be tax deductible.

This allows you to save money while doing something good for the community. However just because you donate to a charity doesnt mean the donation will be tax exempt. When you give away a car or truck you no longer need you free yourself from having to store insure and maintain that vehicle.

The internal revenue service. If you donated a car worth more than 5000 you will need to file a noncash charitable contributions form 8283 and complete section b. A written appraisal of your car from a qualified appraiser is also required.

The irs has very specific rules when it comes to claiming a tax deduction for donated vehicles.

Car Donation Tax Deduction Tax Benefits Of Donating A Car

Car Donation Tax Deduction Tax Benefits Of Donating A Car

How To Donate Car To Charity Ganvwale

Donate Car For Tax Credit How To Get Tax Deduction For

Donate Car For Tax Credit How To Get Tax Deduction For

How To Donate Car For Tax Credit Internal Revenue Code

How To Donate Car For Tax Credit Internal Revenue Code

Donating A Car To Charity You Might Want To Pump The Brakes

Donating A Car To Charity You Might Want To Pump The Brakes

2019 Car Donation Tax Deduction Guide And Faq

2019 Car Donation Tax Deduction Guide And Faq

Where To Donate Your Car Best Car Donation Tax Deduction

Where To Donate Your Car Best Car Donation Tax Deduction

Kpfk Vehicle Donation Program Kpfk 90 7 Fm

Kpfk Vehicle Donation Program Kpfk 90 7 Fm

Donate Your Vehicle To Azpm And Receive A Tax Deduction Azpm

Donate Your Vehicle To Azpm And Receive A Tax Deduction Azpm

Donating A Car To Charity Freeze Sulkov Associates Cpas Pc

Donating A Car To Charity Freeze Sulkov Associates Cpas Pc