But although this approach has been taken by some homeowners its not always the best move. If youre in the market to buy a car you can also use a home equity loan to purchase a vehicle with cash.

You generally dont get a clear title in those cases.

Can i use my home loan to buy a car. The short answer is yes you can. That means you might own a significant portion usually over 20 of the house and can use that as an asset to use as collateral to finance other assets investment properties recreational vehicles or cars. This means you either refinance with your existing lender by negotiating a better rate or you switch to a new lender to take advantage of different features or service both of which can help you access funds to buy your new wheels.

Taking cash out in the form of a home equity loan or line of credit allows you to use the funds for almost anything. Pros cons of paying car loan with heloc. May 18 2009 in debt.

But it can be much more serious in a home loan. What this means is that if you take money out of your home loan and use it to pay off your car then yes you have financed your car at a lower interest rate but you are now paying the loan over a longer period and you actually end up paying more interest this way. Can you use a personal loan to buy a car.

Determine your budget. Most personal loans are provided without any restrictions on what the money is used for. If youre buying a car that isnt eligible to be used as security you may also be able to use your home as security for the loan to lower your interest rate although beware if you default on your repayments.

Yes the home loan interest rate is lower but remember a car is generally financed over 54 months sometimes 60 whereas a home loan is generally financed over 20 years. The vehicle you buy secures the loan so the lender takes less risk. Theres no rule that prevents you from buying a car with a home equity loan.

Another way of using your home loan to purchase a car is to refinance your mortgage. Some people view using a home equity loan to buy a car as some kind of financial life hack because it gives you the flexibility to pay the loan in a shorter or longer term and you can use the. If you have a long term home loan and have been paying it off for a while now youve probably built up equity in your home.

This would considerably improve your debt to income ratio and allow you to qualify for a larger mortgage while still allowing you to own nice almost new cars. Auto loans are similar to home purchase loans. Most cars depreciate in value very quickly so buying a one or two year old used car can save you between 5000 and 15000 assuming the car cost 25000 new.

How Will Buying A Car Affect My Home Loan In Process

How Will Buying A Car Affect My Home Loan In Process

Malaysia Personal Finance Use Home Loan To Buy Car

Malaysia Personal Finance Use Home Loan To Buy Car

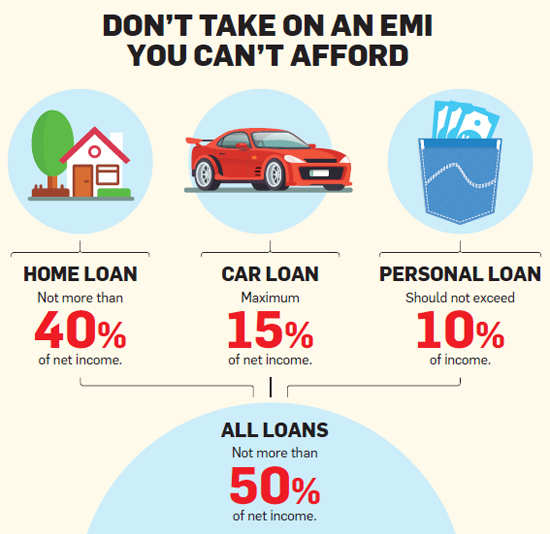

Five Basic Rules To Follow When Taking A Loan The Economic

Five Basic Rules To Follow When Taking A Loan The Economic

How To Use Your Home Loan To Save On Your Next Car Your

How To Use Your Home Loan To Save On Your Next Car Your

Can I Afford A Car In Singapore Icompareloan Resources I

Can I Afford A Car In Singapore Icompareloan Resources I

Here S What You Need To Know Before Applying For A Car Loan

Here S What You Need To Know Before Applying For A Car Loan

9 Things Home Buyer Shouldn T Do During The Buying Process

9 Things Home Buyer Shouldn T Do During The Buying Process

Ways In Which A Used Car Loan Can Make Your Life Easier

Ways In Which A Used Car Loan Can Make Your Life Easier

Should You Foreclose Your Home Loan The Economic Times

Should You Foreclose Your Home Loan The Economic Times

What Credit Score Do I Need To Buy A Car Credit Com

What Credit Score Do I Need To Buy A Car Credit Com